https://corpgov.law.harvard.edu/2024/12 ... on%20grant.

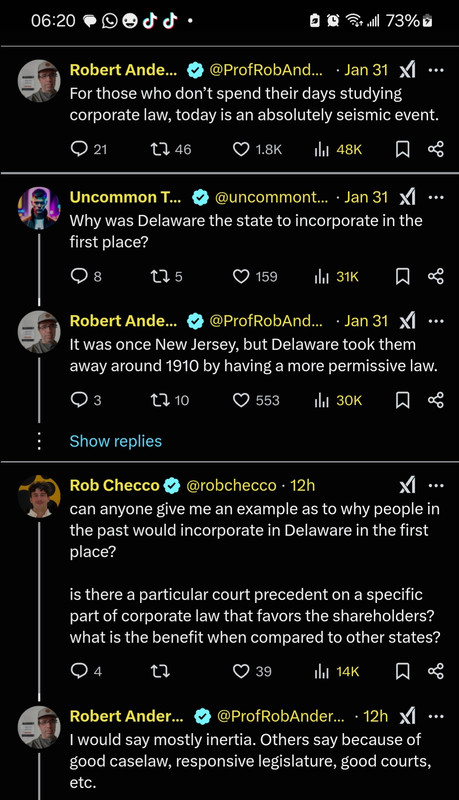

THE BEGINNING

THE VERDICT

A Delaware Court has rejected Tesla’s attempt to reinstate Elon Musk’s court-rescinded options despite Tesla’s shareholders “ratification” of the options.

Tesla and Musk could appeal the latest court decision or the earlier decision which initially struck down the Musk option grant.

Separately, the Court approved record-setting attorney fees in the amount of $345 million, down from the initial fee request of $5.6 billion.

Background

The saga of Elon Musk’s option mega-grant continues. Shareholders first approved the multi-billion-dollar option grant in 2018. A Delaware court judge rescinded the grant on January 30, 2024, followed by a shareholder vote ratifying the rescinded option grant on June 13, 2024. On June 30, 2024, Tesla filed a motion with the Delaware court seeking reinstatement of the option grant on the basis of this shareholder ratification. On December 2, 2024, the Delaware court rejected Tesla’s motion and let stand its decision to rescind the grant.

Against this backdrop, Tesla’s market capitalization has increased from approximately $50 billion to an extraordinary $1 trillion+ over the same time period. This increase in market capitalization has driven the in-the-money value of these options to approximately $100 billion!

Delaware Court Rejects Tesla’s Attempt to Reinstate Musk’s Grants

On December 2, 2024, the Delaware court minced no words in its wholesale rejection of Tesla’s motion to reverse the court’s decision rescinding Musk’s option grants. At the outset of its decision, the court acknowledges that “the large and talented group of defense firms got creative with the ratification argument.” The pleasantries ended there with the court finding that defense counsels’ “unprecedented theories” underlying the ratification argument “go against multiple strains of settled law.” In particular, the court noted that counsels’ theories were defective in the following ways:

• The defendants have no procedural ground for flipping the outcome of an adverse post-trial decision based on evidence they created after trial and noting that “[w]ere the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable”.

• Common-law ratification is an affirmative defense that must be timely raised, which means that, at a minimum, it cannot be raised for the first time after the decision.

• What the defendants call “common law ratification” has no basis in the common law, a stockholder vote standing alone cannot ratify a conflicted-controller transaction.

• Even if a stockholder vote could have a ratifying effect, it could not do so here due to multiple, material misstatements in the proxy statement seeking shareholder ratification.

The court noted that each of these defects standing alone defeats Tesla’s motion to reverse the court’s prior holding.

Tesla has already indicated that it will appeal the court’s decision to the Delaware Supreme Court. When the appeal will be heard, and a decision rendered is not known at this time.